Table of Contents

ToggleRevealing Shocking Ultimate Facts on iPhone 17 Market Dip

iPhone 17 Series Launch: Market Dip & Investor Sentiment

Launch Highlights

Apple’s iPhone 17 series is finally here, featuring upgraded cameras, refined design tweaks, and a slightly lower price tag in India compared to last year.

Market Reaction

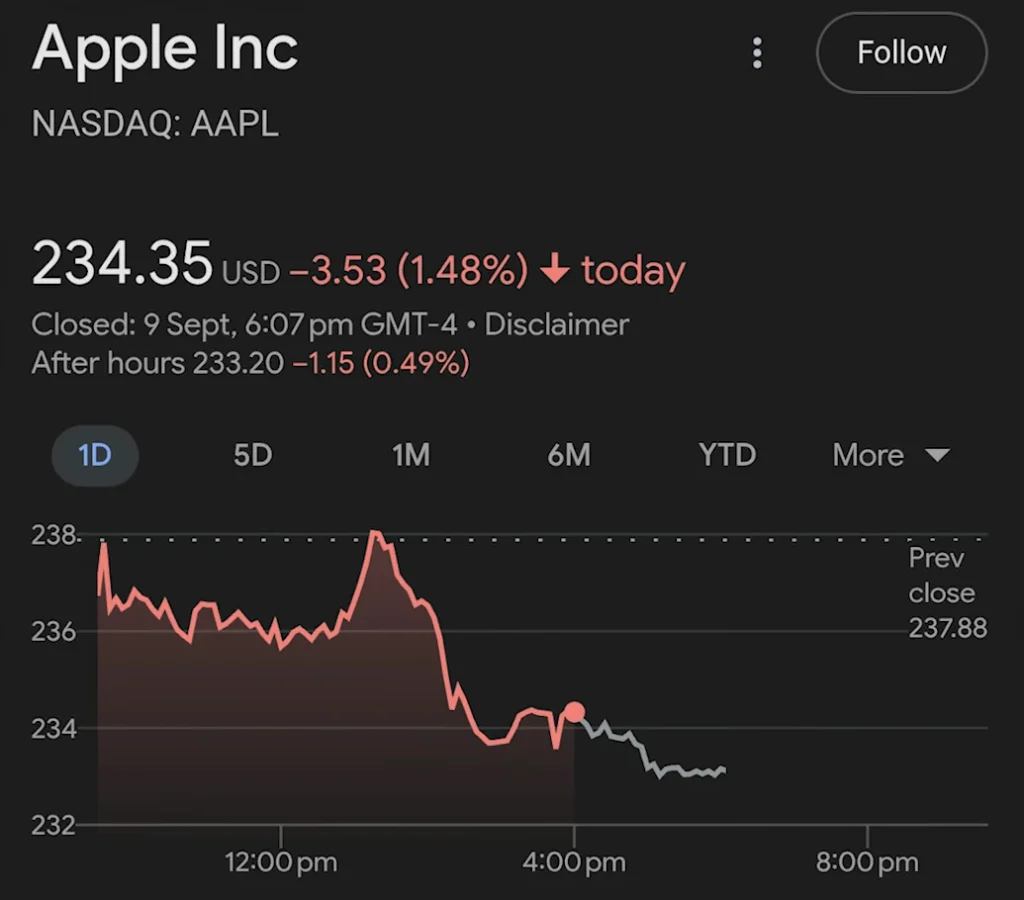

The share price of Apple fell by 1.48% immediately after the launch, translating into an estimated $108 billion loss in market value.

Reports suggest investors were disappointed, viewing this update as incremental rather than revolutionary. Many expected a groundbreaking feature but found the changes modest.

Despite positive reviews from tech analysts, Apple’s stock (AAPL) slipped roughly 2% in the two trading sessions following the announcement.

My Take

I felt the jump from iPhone 16 to 17 offers valuable improvements in low-light photography and battery life. The slightly lower price in India also adds appeal.

Which iPhone 17 model excites you the most? Share your thoughts in the comments below!

Investors are closely analyzing the recent iPhone 17 Market Dip to predict future stock performance.

Several financial reports blame incremental updates for the iPhone 17 Market Dip.

The unexpected iPhone 17 Market Dip erased over $112 billion from Apple’s market value in just two days.

Despite positive reviews, the iPhone 17 Market Dip occurred due to a classic “sell-the-news” effect.

Analysts remain divided on whether the iPhone 17 Market Dip presents a buying opportunity.

Concerns over squeezed profit margins also contributed to the iPhone 17 Market Dip.

Widespread social media backlash over the new design intensified the iPhone 17 Market Dip

The lack of a groundbreaking “must-have” feature is being cited by many as a primary catalyst for the iPhone 17 Market Dip.Ready to upgrade?

Explore iPhone 17 on FlipkartiPhone 17 Series Launch: Market Dip & Investor Sentiment

Analyzing how Apple’s latest flagship release impacts stock performance and investor confidence

Introduction

With the release of the iPhone 17 series, Apple has once again established itself as a leader in innovation. Anticipation for the September keynote was extremely high, with everything from improvements in camera technology to the debut of next-generation A-series chips. However, an unanticipated decline in Apple’s share price in the days after the launch sparked discussions in boardrooms and trading desks around the globe.

Launch Highlights

Three models were displayed by Apple: the entry-level iPhone 17, the high-end 17 Pro, and the flagship 17 Pro Max. A periscope telephoto lens, more effective OLED panels with adaptive refresh rates up to 120 Hz, and satellite-based SOS for remote connectivity are some of the major improvements. As the Pro Max gets closer to $1,499, these features raise concerns about price elasticity while also reaffirming Apple’s dedication to camera and battery performance.

Market Reaction: The Dip Explained

Despite positive reviews from tech analysts, Apple’s stock (AAPL) slipped roughly 2% in the two trading sessions following the announcement. Several factors contributed:

1. Valuation Concerns: With Apple trading at a premium P/E ratio compared to industry peers, investors were wary of an already lofty valuation being further pressured by limited expansion in revenue guidance.

2. Macro Headwinds: Global economic uncertainty, rising interest rates, and supply chain constraints weighed on market sentiment, making investors cautious about large discretionary spends.

3. Fade Effect: The well-known “sell the news” phenomenon frequently leads to traders locking in profits after purchasing the rumor prior to launch.

Investor Sentiment: What the Pros Are Saying

Major brokerage firms have adjusted their price targets modestly:

Goldman Sachs: Neutral rating, target $200

JP Morgan: Overweight rating, target $225

Analysts generally concur that any decline presents a chance for investors to expand their holdings before the holiday sales season, which usually causes a surge in demand for iPhones.

Looking Ahead: Balancing Innovation & Expectations

Growing its revenue streams outside of hardware is essential to Apple’s future. The Any slowdown in the hardware cycle was lessened by the 12% yearly growth in the services segment, which was fueled by the App Store, iCloud, and Apple Music. A new area for development is also suggested by rumors of a mixed reality headset, which is expected to be released in late 2026.

Nonetheless, investors will be scrutinizing:

• FY26 guidance: Will Apple continue to project revenue in a conservative manner?

• Supply Chain Health: Can Apple avoid Q4 component shortages?

• Macro Indicators: trends in consumer spending before the holidays.

Conclusion

The initial response from the market to the iPhone 17 series highlights the fine balance between innovation and price. Investors are aware of wider economic trends and profit-taking dynamics even as Apple continues to push technological boundaries. Long-term stakeholders may interpret the recent decline as a sign of a favorable buying window before the holidays and upcoming AR/VR product catalysts.